- Home

- ATM & Branches

- About Us

- Help Center

- Learn More

-

- Accessibility

-

-

br

Your checking account in the U.S. that offers solutions and focuses on your financial needs across borders.

The Gold Global Account can be opened online or at any BB Americas Bank branch. By opening this account, you will have access to your account 24/7 through the Online Banking and Mobile App. You will also receive a BB Americas Bank Visa Debit Card with access to 40,000 fee-free ATMs nationwide.

Available for Non-U.S. Citizens or Non-Permanent Residents – BB S.A. Clients

or Employees and CAPES/CNPQ Prepaid cardholders.

Account Details:

- Access your account 24/7 through the Online Banking and BB Americas Bank Mobile App

- Withdraw money fee-free in 40,000 ATMs nationwide

- Unlimited checking transactions

- Free 1st standard check order

- Send money to BB S.A. Personal Accounts in Brazil through BB Remessa

- Pay for your purchases with Apple Pay, Samsung Pay and PayPal

- FDIC Insured

Minimum Initial Deposit:

- $500

Online

Open Your Gold Global Account Through The BB App*Open Your Gold Global Account Through The BB App*

At a Branch

Find a Branch

*The Gold Global Account opening online is available through the BB S.A. App.

Customer support in 3 languages (English, Portuguese, and Spanish).

Monthly Maintenance Fee:

$15

OR

$0*

*When you meet the below requirements:

- Maintain a minimum account balance of US$3,000.00 on any day of the statement cycle;or

- Maintain a combined average monthly balance of US$3,000.00 combined between linked accounts² within the bank statement cycle.

The minimum balance requirement for the monthly fee waiver becomes effective 60 days post account opening date.

BB Americas Bank Visa® Debit Card

$1,000

Daily withdrawal limit:

$5,000

Daily purchase limit:

For more information about the Debit Card, click here.

Features⁴:

Here is what you need to open a Classic Checking:

Open your Gold Global account through the BB S.A. App

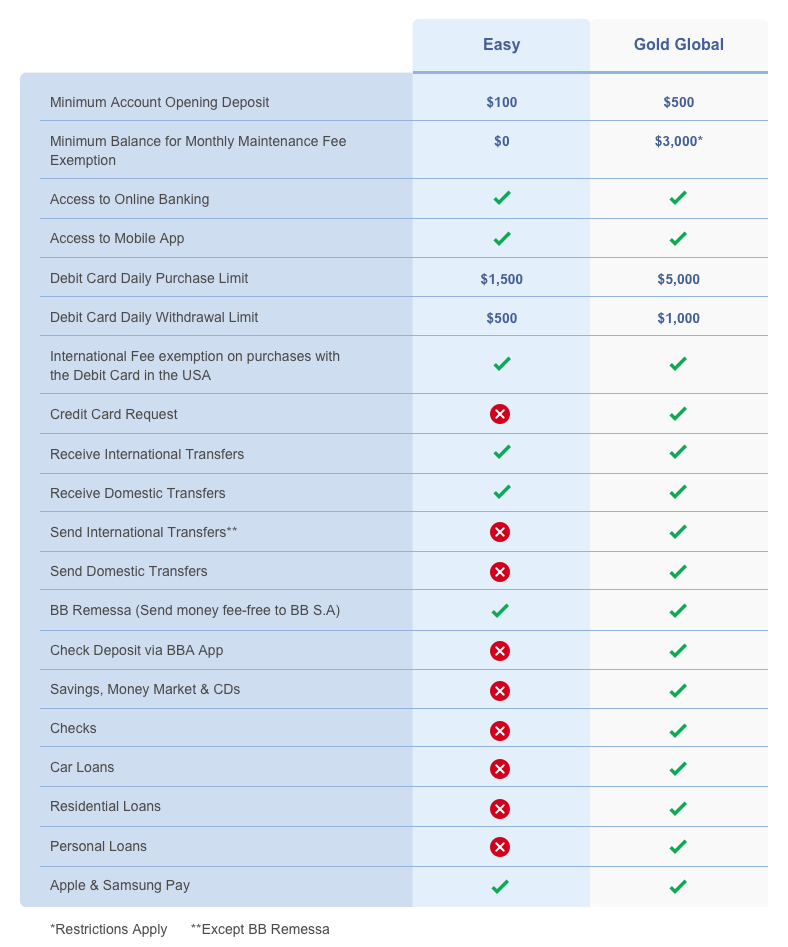

Check out below which solutions are available for the Easy Account and the Global Gold Account to identify which will best meet your banking needs:

¹This account only offers e-statements. This account offers Online Banking. This account does not offer access to some Online Banking tools (BILL PAY). Outgoing wire transfers can be conducted through the Online Banking. The initial deposit to fund the Gold Global account opened online for BB S.A. clients must come from the BB S.A. account of same ownership.

²Qualified linked accounts include Checking, Money Market, Savings, CD and CD Individual Retirement Accounts (CD IRA) under the same banking relationship.

³Mobile Banking: To access the BB Americas Bank Mobile App you must have a smartphone with access to an app store. Mobile messages and data rates may apply.

Mobile Check Deposit: Customer must be enrolled in BB Americas Bank Online Banking. Maximum deposit dollar limit of $5,000.00 within a 5 business day period. If the total sum of multiple mobile check deposits within 5 business days exceeds the allowed deposit maximum of $5,000.00, exceeding amount will be made available in increments of up to $5,000.00 every 5 business days.

Total deposit will be made available on the next business day after the day of deposit, if made prior to the cut-off time. The bank’s cut-off time is 4:00 p.m. EST. Deposits made on a weekend, federal holidays or after the 4:00 pm EST cut-off time will be processed on the following business day. Mobile deposit is only available on iPhone or Android mobile devices with picture capabilities. Mobile message and data rates may apply. Please speak to a BB Americas Bank representative and/or refer to BB Americas Mobile Banking Terms and Conditions for more information.

Send Transfers to Brazil: Transfers must be made from a BB Americas Bank consumer Checking or Money Market account to a Banco do Brasil S.A. consumer account. A valid CPF is required for the beneficiary in Brazil. *Money Market account: By Regulation this account is limited to 6 transactions per statement cycle. If you exceed the transaction limitations, your account will be charged a fee of $15.00 per excessive debit transaction. If you continue to exceed transaction limitations more than three (3) times within a 12 month rolling period will be notified by the Bank and the account will be closed or converted to a Checking Account. Your account may no longer earn interest.

Limits: Minimum Amount US$15; Maximum Daily Limit: Maximum equivalent to R$99.999,99 (Real); Monthly Maximum Amount: US$100,000.00 (Dollar).

ATMs: Visit www.bbamericas.com to find a BB Americas Bank surcharge-free ATM.

⁴The passport is only accepted for account opening in person at one of BB Americas physical branches.